When you’re searching for debt collection software to help make recovering debts simpler, it can be difficult to know what questions to ask that are relevant to this particular channel. It can be easier when looking for a debt collection agency as we’re generally more familiar with people service. Here’s what to look for when you’re weighing up your options for debt collection software as a service. The fundamentals are the same, there are just a few new questions to ask!

1. Is the web interface intuitive and easy to use?

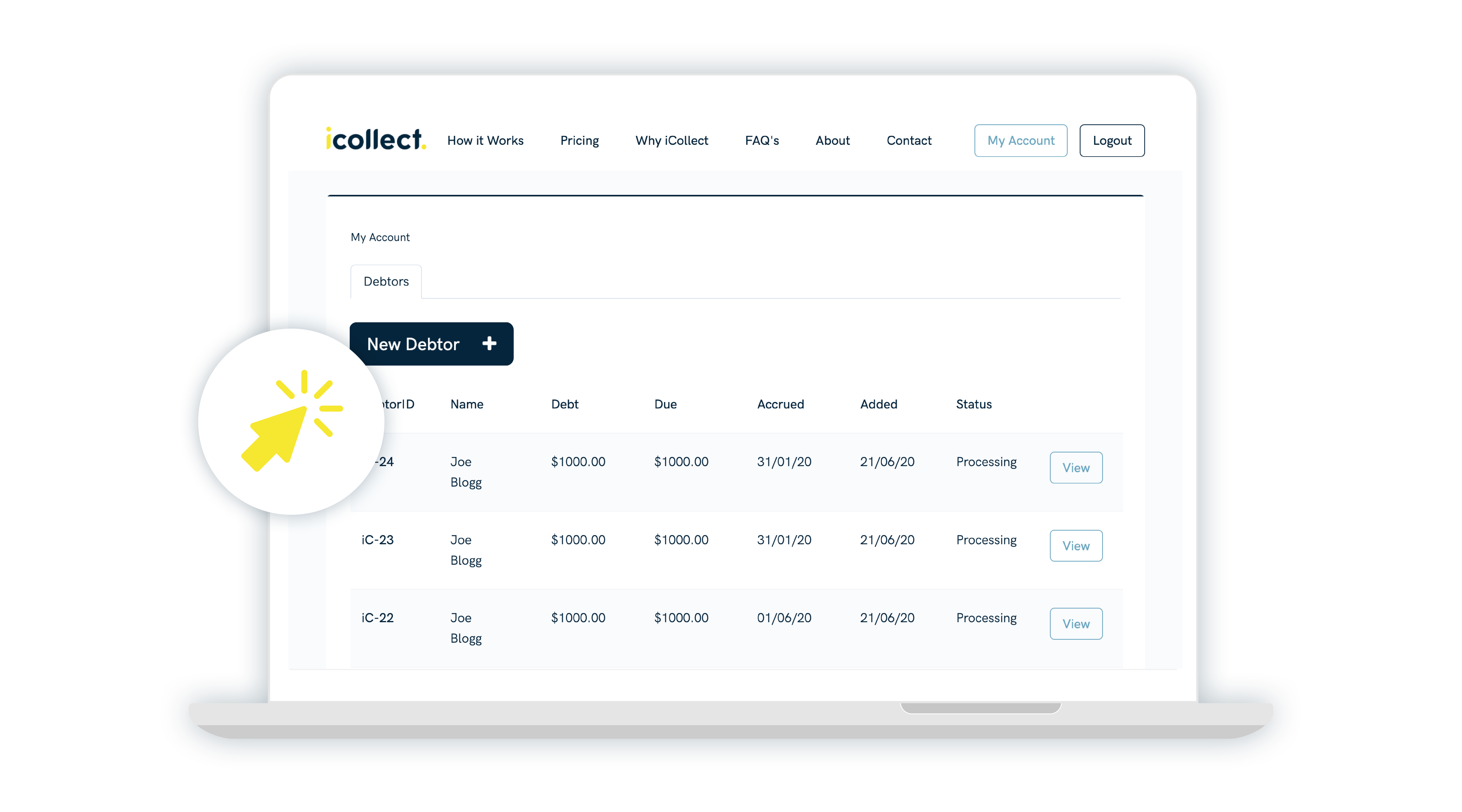

With web design and user experience so advanced these days, debt collection software that is super easy for users to navigate is one of the most important features. After all, late payment of invoices can be stressful, so you’ll be looking for software that is easy to find your way around, including a logical flow and visual cues to take action. Remember that sometimes a simple interface is the best interface – there’s nothing worse than fancy software with a hundred applications that no one actually wants to use.

The same ease of use extends to your debtors. You want to make it as clear and convenient as possible for them to pay you, and as they may not be as familiar as you with invoices and billing, the debtor facing interface also needs to be simple, clear and efficient.

2. How would you like remind your customers when payment is due?

Do you want to send written letters, emailed communication, text messages – or all three? Often debtors prefer one method over another and until you get an understanding of which channel is most effective to get them to take action, you may want to try all three.

3. Would you like the software to automatically send reminders?

The role of online debt recovery is to lower your stress levels, so software that automatically sends reminders if the invoices have not been paid in the stated time can save you a lot of manual work and worry. And of course, you’ll want records in your software about when the communications were sent so all the information you need is at your fingertips to see when payment has been made or if there is a query.

4. Would you like the option of scheduling communications or sending them real-time?

Flexibility to choose when you send invoice follow ups or the choice to push the communication immediately so it arrives within your debtor’s email inbox or text within seconds is must-have functionality for any online debt recovery system. A pause system is also very useful.

5. How do I upgrade software versions when needed?

A good system will update its software as part of the service, so you’ll always have the current version of the system with the latest improvements and additional features.

6. How do I get a summary of payment activity and recovery?

The beauty of a real-time and web-based system is the ability to see what has been sent to debtors, what has been paid and any relevant debtor documentation all kept in one place. This recovery dashboard and information should give you a clear snapshot of status and progress with your debt recovery.

Not to blow our own trumpet here, but simply stating the truth. iCollect’s proven online debt recovery software caters to all your needs above. If you need more proof, listen to the experts as we’ve been voted one of top best debt collection firms in Auckland: https://www.topreviews.co.nz/best-debt-collection-auckland/#4_iCollect