If you don’t pay a debt, the person you owe money to (the creditor) may negotiate with you about the debt or they can take you to court.

It’s also possible that the creditor might get a debt collection agency involved – either just to help them recover the debt or they might sell the debt to a debt collection agency, who will then legally become the “creditor”.

A debt collection agency will first ask in writing for the debt to be paid and provide information about the consequences if it isn’t.

If you disagree that you owe the money, you should tell the creditor or debt collection agency as soon as possible and give your reasons.

If the debt is $15,000 or less, a claim can be taken to the Disputes Tribunal. Claims between $15,000 and $20,000 can also be taken to the Tribunal, if both sides agree to dealing with the dispute this way.

Claims can be taken to the District Court if the debt is not more than $200,000, or the High Court for a debt of any amount but usually over $200,000.

The court can order the debt to be paid off by instalments, they can order an employer to take money directly from a person’s salary or wages to pay the debt, and they can issue a warrant to seize money or goods belonging to the debtor. Goods can only be repossessed if the signed contract explicitly allows this.

If the court is satisfied that the debt can be paid but the person is simply refusing to do so, it can order them to do community work for up to 200 hours.

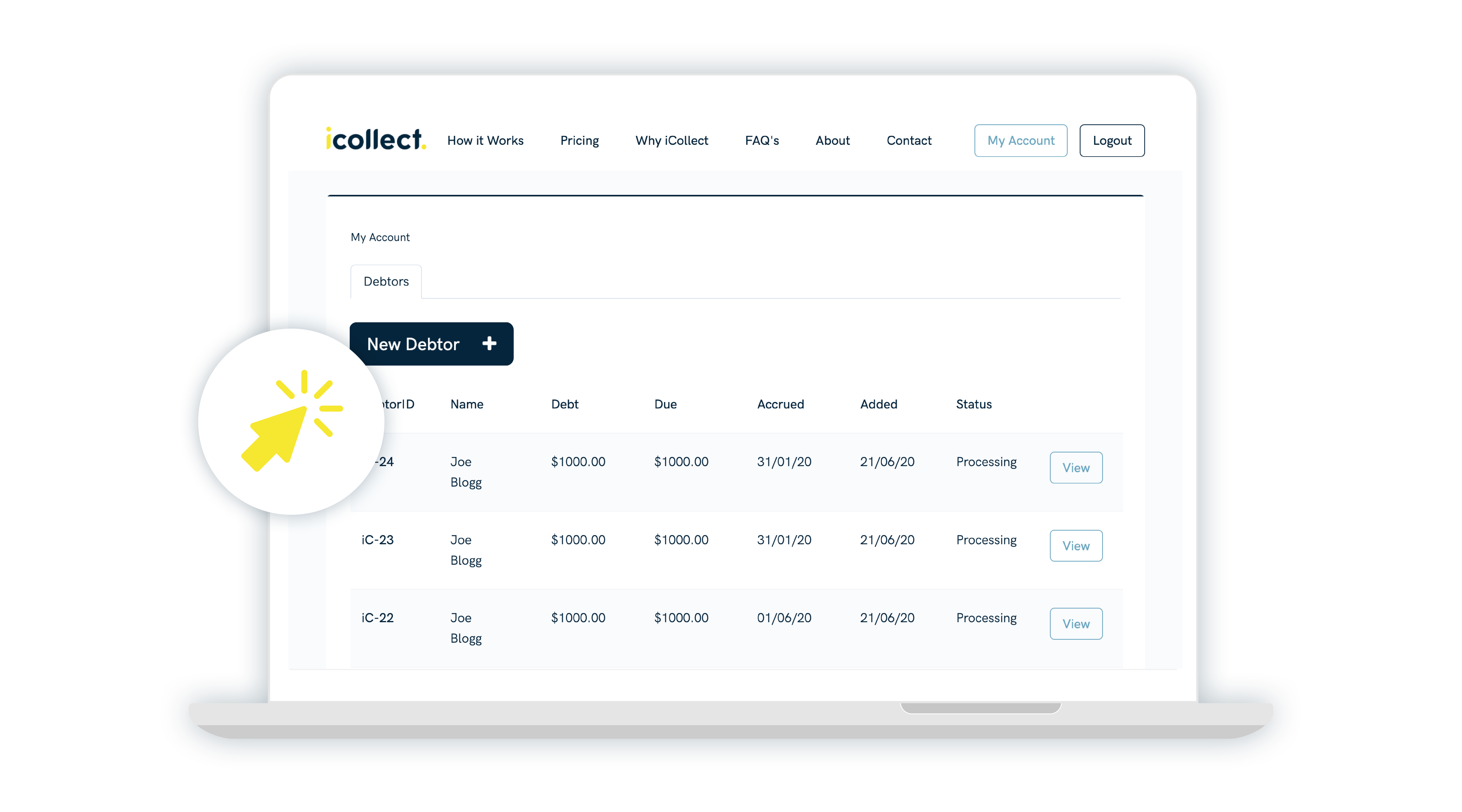

If you need help with unpaid debts, consider iCollect business debt collection software, serving businesses in Auckland, Wellington and Christchurch for over 10 years.