The world of debt collection can be confusing. With the modern world comes more choice, which translates into more decisions. When it comes to debt collection services, what’s best for you? Hiring an agency or using debt collection software?

If you’re reading this, then you’re probably sick and tired of chasing unpaid invoices and debts. Outsourcing this chore to a debt collection agency can be a wise move, but sometimes your needs just aren’t big enough to justify hiring a specialised agency. In this case using an online solution could be just right for you.

What online debt collection options are out there?

1. Online accounting systems can help with initial follow up of accounts, for example Xero sends out a reminder from its system when clients haven’t paid their invoices. The drawback here is that most people know this is an automatic reminder and so it can be difficult to spur late payers into action.

2. Other external providers may help you to send out communications using your own in-house branded documents. While this can help, there isn’t much urgency or gravitas to spur stubborn (un)payers to pay their invoice. On the other end of the spectrum are companies who facilitate communications to debtors through a law firm. While that certainly gets the attention of late payers, the costs can add up quickly.

3. Debt collection software agencies like iCollect specialise in affordable and effective debt collection solutions. Easy to set up and action, iCollect sends automated letters to your debtors, with the backing of a debt collection agency. You’re in control, and your debtors are presented with communications from a respected debt collection agency. This has been proven to speed up payments and achieve results that benefit your cash flow.

What agencies or other avenues are available?

Hiring a debt collection agency has been a popular option in the past, especially in the days before software and digital tools became so prevalent and smart.

An agency can look after everything from the beginning to end, although as they pass on their fees to the debtor, getting a debtor to pay the original amount owed, plus additional charges can be a challenge. And in a world where we like to be in control and have all the information at our fingertips, iCollect’s DiY solution is gaining more and more traction with Kiwi business owners.

What’s right for me?

Everyone’s situation is different, and your debt collection needs may fluctuate seasonally or during a tough economic patch with your clients. Debt collection software is beneficial as it means you can bring the process inhouse with the weight of the debt collection agency behind you while controlling it all. Clients who use iCollect do so because of these three attributes:

· Control: as business owners we like to understand what’s happening and be able to influence outcomes wherever possible. iCollect’s system of communications put you in the driver’s seat. You choose when to push go on the series of triggered letters, email and text communications.

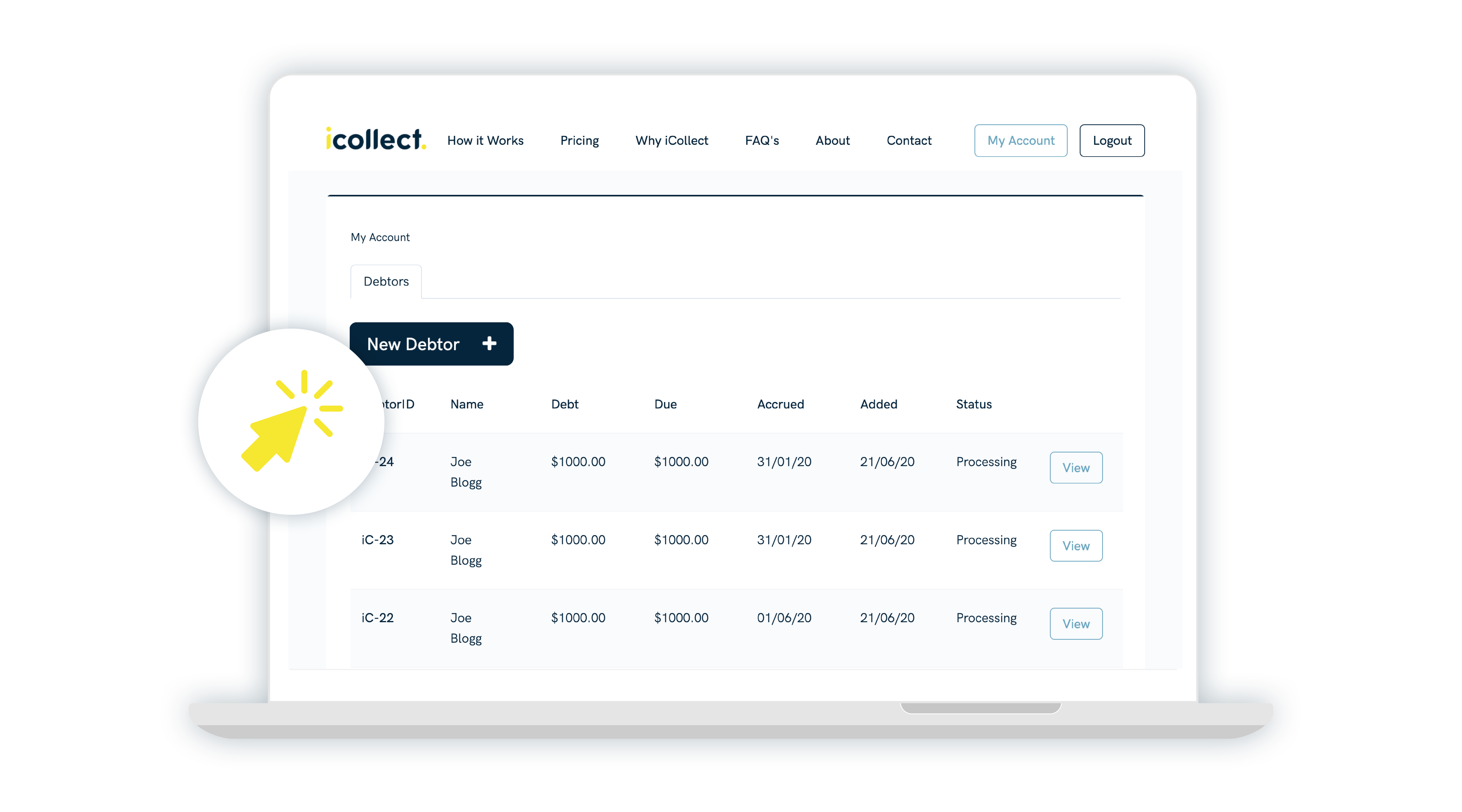

· Visibility: with a traditional debt collection agency, you may need to make a call or email to see where things are at in the process. iCollect’s client portal has all the information you need at your fingertips, including communications that have taken place, any payment plans, and payments made or in progress.

· Flexibility: a proven way to encourage late payers to start paying off their debt is to work on a payment plan with them. With iCollect, the system is flexible and smart enough so that the communications to the debtor change values depending on the amount of the debt paid or the plan that has been agreed.

Ultimately, your choice comes down to your preferences and your comfort levels. Although just as accounting systems themselves have made leaps and bounds, online debt collection software is currently doing the same!