Credit control management. A bit of a mouthful to say, but it’s an essential function in every business. But what does it mean? Credit management encompasses all financial services related to company cash flow into a business, which is essential for business stability or growth. If your company has poor credit control policies in place, you may struggle to recover your debts.

The most important functions of credit management are payment collection, and the management of client relationships to monitor payment performance. Establishing clear procedures for credit is a priority for your business before you even open the doors to sales.

If you don’t have strong credit processes and procedures in your business, getting these in place is the first step towards better cash flow. At the minimum you should have a team member who is able to administer the following for you:

· Adhere to legal requirements with opening a new client account

· Help to encourage client payment – on time

· Create and upload credit policies that follow legislation and laws, and ensure your business cash flow is fluid

· Review unpaid invoices and make a plan or process to contact the debtor

· Monitor payment history and highlight patterns, including frequent flier late payers

· Follow up with outstanding accounts

· If it comes to this, understand the legal process around unpaid debts or debt recovery.

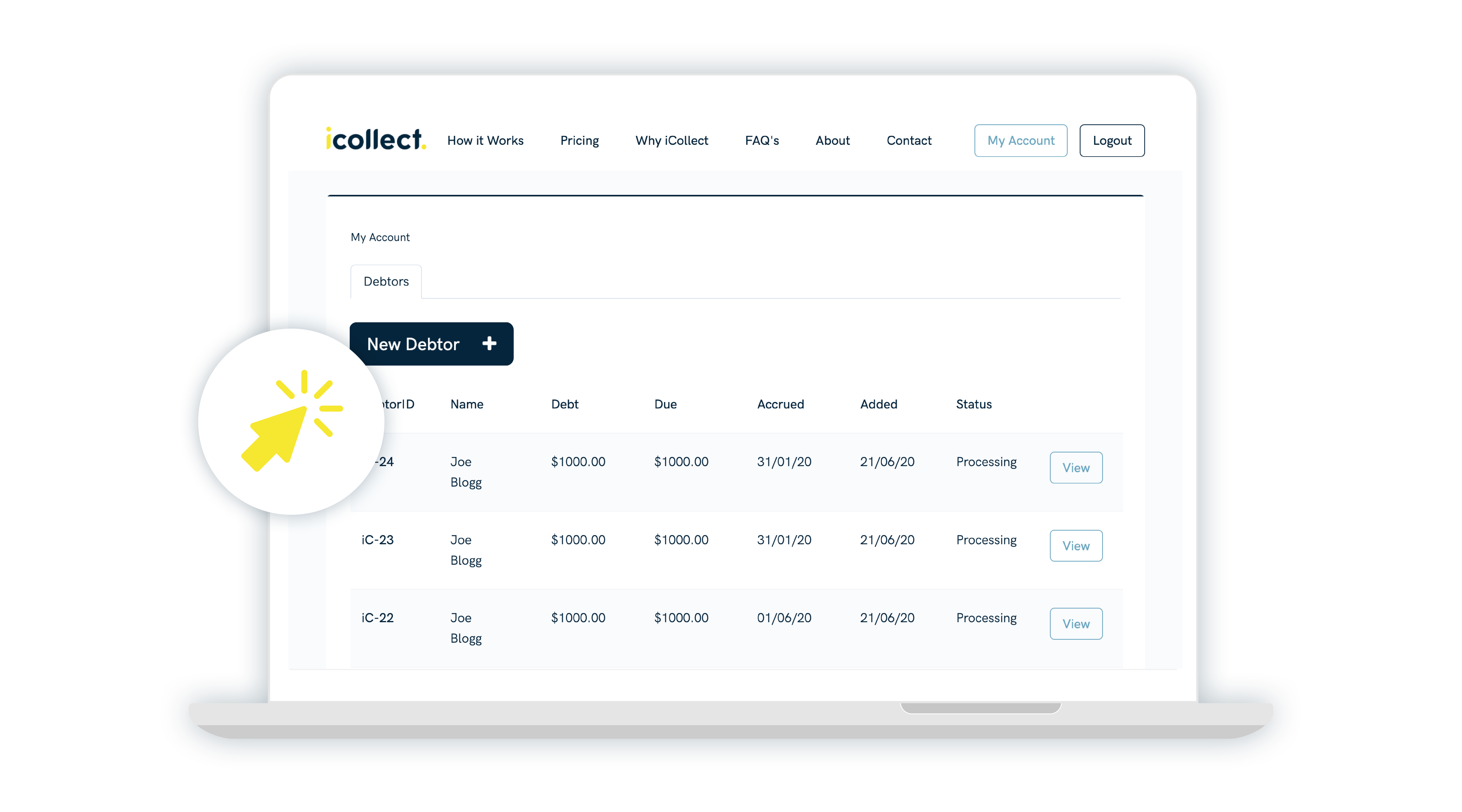

Your ultimate goal is to sustain cash flow, so there may be times when you need to call in a debt collection firm or use the services of an online DiY debt recovery service like iCollect, which can spur debtors to pay, or help you to chase outstanding invoices. It is also a time-saving and cost-effective strategy, especially if you don’t have the need for a full-time credit management staff member, or someone who has both the capacity and capability to take this on as part of their role.

Getting started

The best way to start to implement good credit management processes in your business is to write down some simple process/methods. This should be communicated to your entire business, including sales and customer services, and should be signed at the outset of any relationship with a new client.

This process should include the following:

· How you will issue invoices and when. A good practice here is to issue an invoice immediately after delivering your product or service.

· The length of time a customer has to pay you.

· Steps you will take if the debt is unpaid by the due date, including any late fees.

Whatever route you decide, a crucial factor to keep in mind is that managing your relationship with your clients in a reputable and ethical way to key. Ensuring your staff are always professional and calm, and by their actions reflect positively on your brand and your business, are all essential elements of the credit control management process.