As any debt collector knows, being owed funds is a tricky situation to be in. Your priority is getting the money owed to you into your account, but customers are hard earned, and the last thing you want to do is lose a client to a competitor.

Made even more complicated is the issue of debt conflict, where there is disagreement between the debtor and creditor on the details of a payment or invoice. Handling such disputes well can be the difference between keeping and losing a client. With that in mind, here are some tips to resolve conflict with debtors.

Stay Professional

You have a professional relationship with your client, keep it professional as you bring up any disputes. Maintain the level of respect and friendliness that you would normally use; don’t be rude or let any frustrations over the debt show. Using debt recovery software helps maintain a professional relationship with your debtor before conflict arises.

A good tip is to refrain from sending emails on the topic until you have a calm head – emotionally charged emails can quickly damage a professional relationship. The goal is to resolve conflict, get paid and get back to your former healthy relationship – losing your cool or embarrassing customers is a good way to lose them.

Open-Mindedness and Understanding

Start out with an open mind to try to understand the client’s point of view. The conflict could be a simple miscommunication either between you and your client or between staff members within the client’s business. If you can understand the cause of the conflict, you can solve it more easily.

Also, be open to the fact that you could have made a mistake. You could have sent an invoice twice or forgotten to include that monthly special you advertised. Creditors can be in the wrong when it comes to invoice disputes – the sooner you discover your mistake, the less embarrassed you will be!

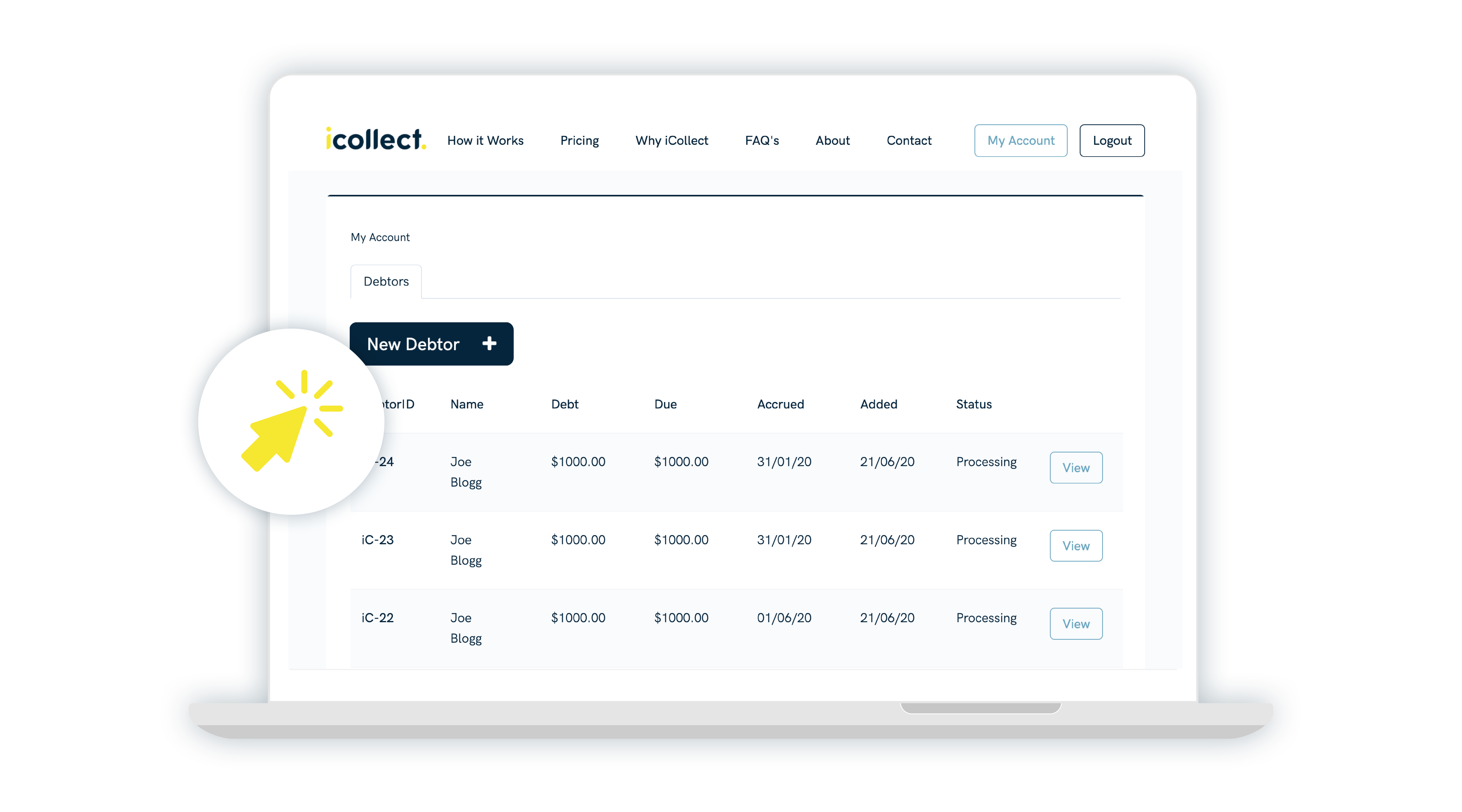

Use Debt Collection Software

Using debt recovery software allows a third party to take over the task of debt collection, which is proven to be more effective than trying to collect debts yourself. Conflict can still arise for genuine reasons, but debt collection software helps limit the number of conflicts that are actually just procrastination techniques.

If conflict does arise, iCollect’s debt recovery software will walk you through a procedure to resolve conflict as well as provide free advice on how to manage the situation.

Record Keeping

Good record keeping is the cornerstone to good accounting. Organisation will limit mistakes on your end and make effective debt collection easier as you can quickly identify and resend any invoice, bill, or other documents that will help you get to the bottom of a disagreement.

Also, if a conflict does arise, keep record of the conflict itself by keeping emails and notes. This will help you if things escalate as well as give you tips on changing procedure to avoid the same issues from happening in the future.