Are you struggling to get debtors to pay the full amount of their invoice? If so, the secret to success could be to offer an accessible payment avenue for debtors with structured payment plans. As they say a bird in the hand is worth more than two in the bush, so even part payment this month is better for your books than no payment at all!

Be empathetic

We all like to do business with the attitude that people who purchase goods or services from us do intend to pay, however as we’ve seen especially since Covid hit, sometimes well-intentioned people fall on hard times and are unable to pay all of their outstanding invoices when they are due.

Just as we gave them the benefit of the doubt in the first place, in hard situations, it pays to also remember this. It can generate goodwill with the customer and create positive word of mouth in the industry. Plus, accepting payment in instalments of part payments increases the likelihood of collecting the total amount due, although it may take a little longer.

Small payment chunks

It also pays to think about human psychology in this area too. It’s proven that customers feel more comfortable with paying a small amount than they do a large amount. Smaller and more frequent payments, e.g. weekly, often get outstanding results in ensuring your debtors pay their invoices in full. And if the inevitable happens and a payment bounces, the smaller amount has a smaller effect on your cashflow.

Speaking of cashflow, steady and reliable cash coming in is the key to a successful business. Reliance on large on-off payments can increase your vulnerability if these are not paid or are not repeated. Payment plans also ensure you have regular cashflow, helping you to pay your own invoices.

Choose your payment day

Now, we’re getting down to brass tacks here, but even small tactics like ensuring your payments are due on the preferred days for customers to pay, can increase your percentage of debts paid on time. And those days? Statistics show that Thursdays, Fridays and Mondays are the most preferred payment days.

Front foot payment dates

A key point to remember is that payment plans don’t need to come into effect after a payment is late. Choosing and communicating the right payment terms from the outset can give you the edge on faster payment. A Xero study found that, on average, customers pay two weeks later. So, it’s suggested that you should add two weeks to estimate the actual date when you’d like payment. If you’d like to be paid in 30 days, then think about payment terms of 13 days. When you are communicating the payment terms be very clear about when this term begins so there is no room for miscommunication or contesting the time period.

Another two options to incentivise debtors could be either a small discount for early payment or a late payment fee. Some people are more motivated by the carrot, others the stick!

Whatever path you decide for payment terms and plans, the key to success is being upfront about your payment terms and conditions both in your agreements and on the invoices themselves.

Final nugget of advice

Perhaps the best piece of advice in this area is to ensure your relationships remain intact with your clients. Be open to hearing from your debtor, provide firm but professional communication and remember that empathy goes a long way. After all, as a business owner yourself, you’ll know about the ebbs and flows of money. Of course, this doesn’t mean being a push over. Once a payment plan is worked out, hold your debtors to these payments, and remind them if they are still overdue.

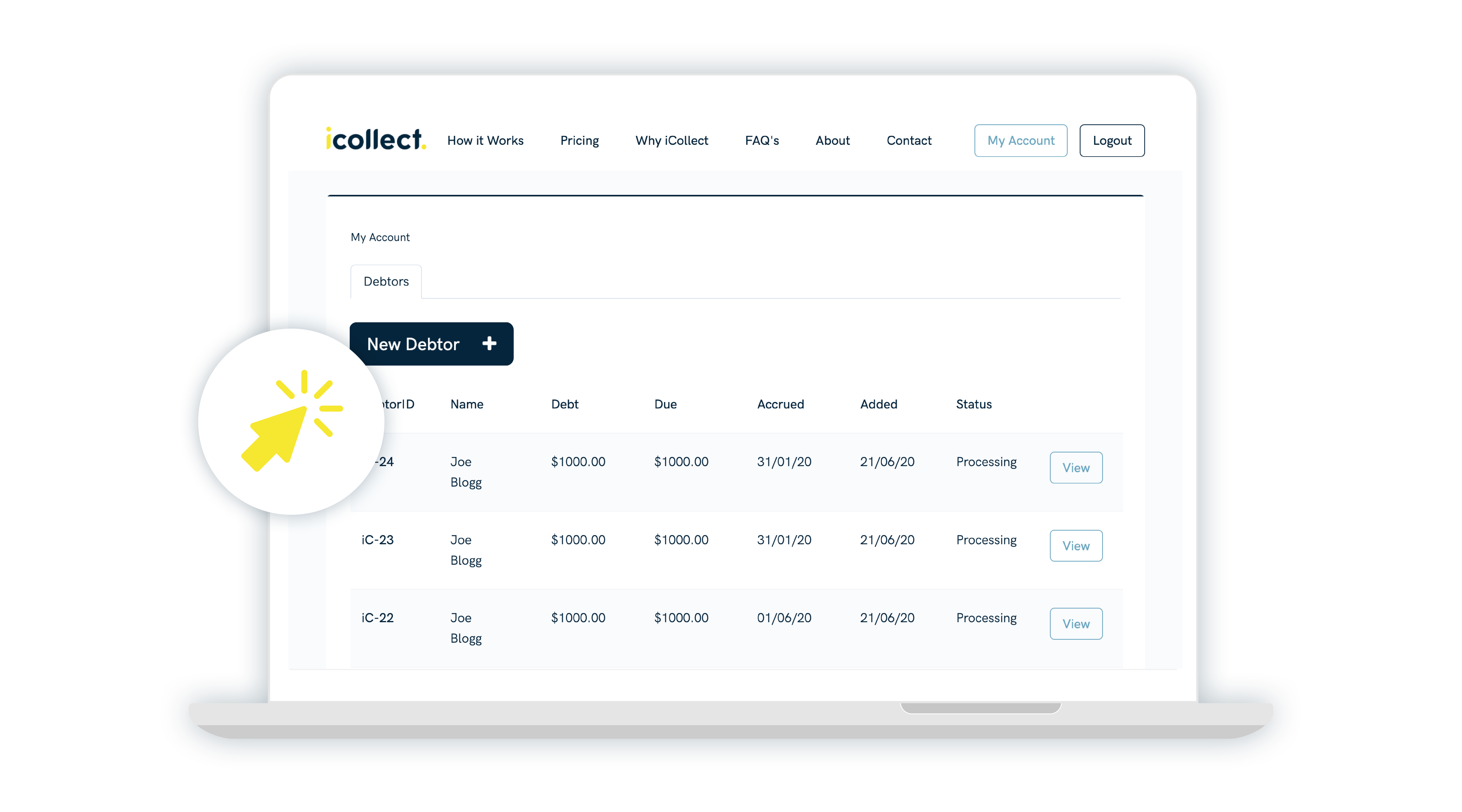

iCollect’s debt recovery software can be of immense help when creating and fulfilling payment plans. As well as sending communications for due dates, you can also automate reminders for promised payment dates too.