They say patience is a virtue, but like invoice deadlines, patience runs out at some point. Unfortunately, some debtors just won’t budge and have no intention, or perhaps no ability, to make their payments. While we hope we don’t get to this stage, what happens in the debt collection process as you edge closer to arbitration?

If we can stress one thing here – it’s the importance of keeping a paper trail. Record keeping is essential in any business, and in cases of outstanding debts, proof of communications is even more crucial. Having your invoices and receipts at hand is one part of the equation, and if you need to take debt collection to the next step, keeping records of communication with your debtor is extremely important. If in doubt, save, keep and file somewhere where you can locate it easily if needed!

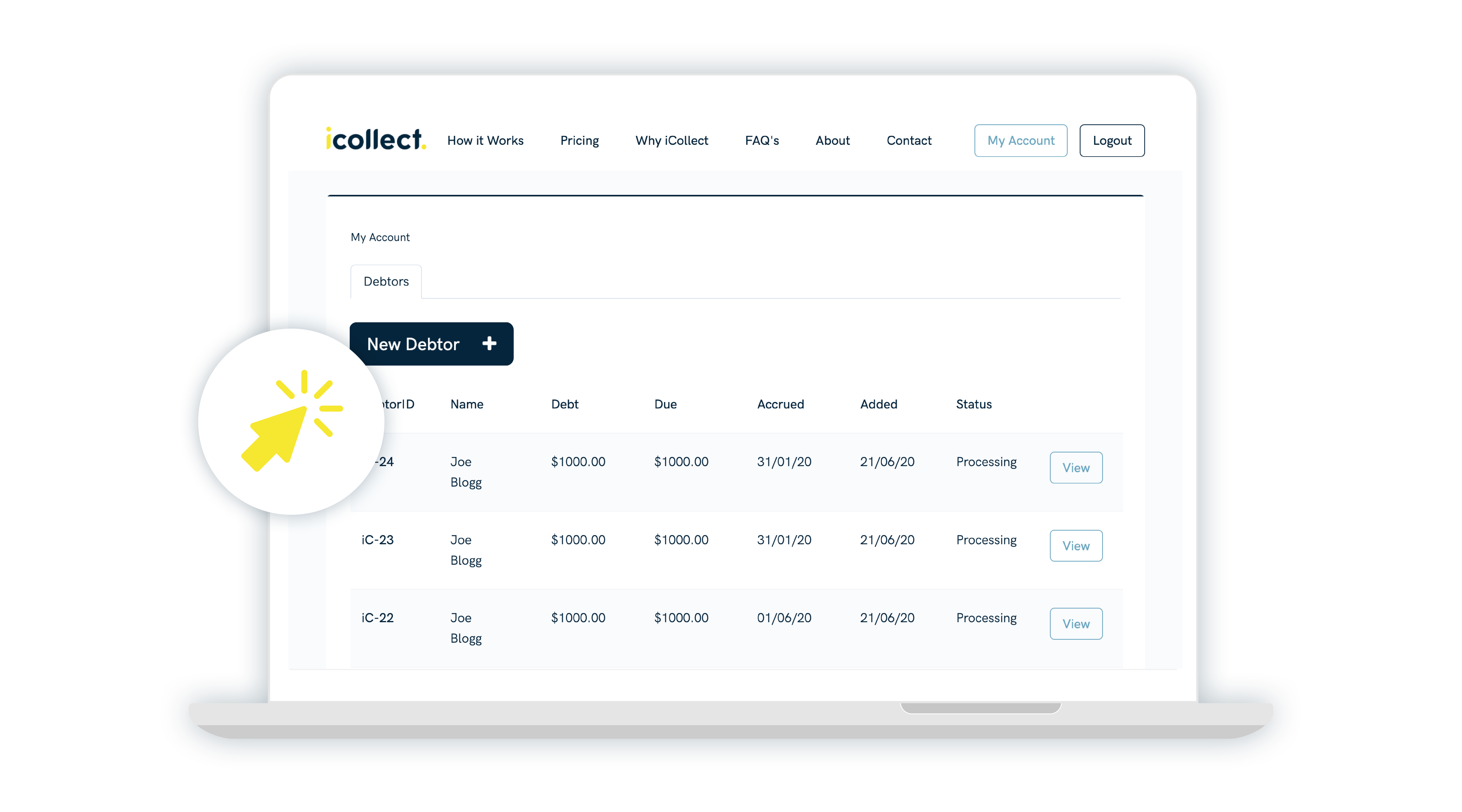

Comprehensive record keeping refers to everything, even if it’s not paper or digital based. Keep note of all communication, including calls, emails and documents. iCollect can record these for you, so that if you do need them for court proceedings, all the information is stored and easily located in one place.

Your options when you’ve exhausted other debt collection avenues

1. If you’ve reached this fatiguing point, one option is to hand over the debt to Guardian Credit Services. Guardian Credit Services is the third-party debt collection agency that iCollect is aligned with. It’s their agency that features on the letterhead of the communications sent from iCollect’s online debt recovery software. Guardian Credit Services has been collecting debt for New Zealanders for the past 25 years and has substantial leverage power in the debt collection process.

2. Another avenue is for you to register a default. This means that the personal details for the debtor and the value of the debt owing will be registered with Equifax, which is a national database of debtors with outstanding debts against their names. The default will last against their name for up to five years. During that time if the debtor wishes to get credit approved, they will not be able to until the debt is paid, effectively giving them a bad credit rating.

A bad credit rating can be quite debilitating and can hinder the chances of the debtor getting finance, credit cards or a loan.

3. We’ve had clients who’ve asked us whether they can take a debtor to the Disputes Tribunal, however the tribunal isn’t a debt collection agency so can’t help with clients who aren’t paying up. It only addresses disputes over the debt itself. The District Court can order people to pay their debts. However, like anything legal, this action can be costly and can take time. Often the result doesn’t justify the means.

How much do these options cost?

· Sending the debt to Guardian Credit Services costs $39 + GST per debt. As Guardian adds this cost to the collection amount for the debtor to pay, this means that for you the collection is free if the full debt and fee is collected from the debtor.

· Registering a default costs $30 + GST.

· District Court costs can add up quickly and it’s difficult to predict final costs.

If you’re getting frustrated with clients who appear like they’ll never pay their debts, remember you have a range of options. Weighing up the timeliness of action, the costs incurred and the reality of your client being able to pay is important, so using a solution that balances cost, effectiveness and proven methods that get the job done is a wise move!